Welcome to the next generation adviser platform business. Here at Wealthtime, you’ll find a smarter technology experience that places you at the core of everything we do.

Following years of hard work and continuous development across two separate platform products, we’ve built a group that’s able to combine top tier technology with a people-centric service. This combination means you can choose which of our two platforms – Wealthtime or Wealthtime Select – best suits you and your clients’ needs. Regardless of which platform you go for, you can take advantage of a service that not only gets the day-to-day essentials right first time, but is also constantly evolving and adapting to change.

We’re always striving to add value and create great outcomes for investors. And as two of the last remaining independent platforms, we’re able to align to your business needs – there’s no direct-to consumer arm or team of advisers competing with you for the same clients.

£11bn

1,500

75,000

One group, two platforms

Wealthtime offers two separate and distinct solutions to satisfy client needs; Wealthtime and Wealthtime Select. Bringing both businesses together under one group name unifies and builds on the strongest aspects of both platforms.

A single group vision allows us to present a seamless and consistent user experience with the best proposition and outcomes for you and your clients.

What we offer you

We can provide you with a comprehensive investment wrap service regardless of which platform you choose. You’ll find everything you’d expect from an advisory platform plus market leading technology and service.

1

2

3

4

Service that truly supports

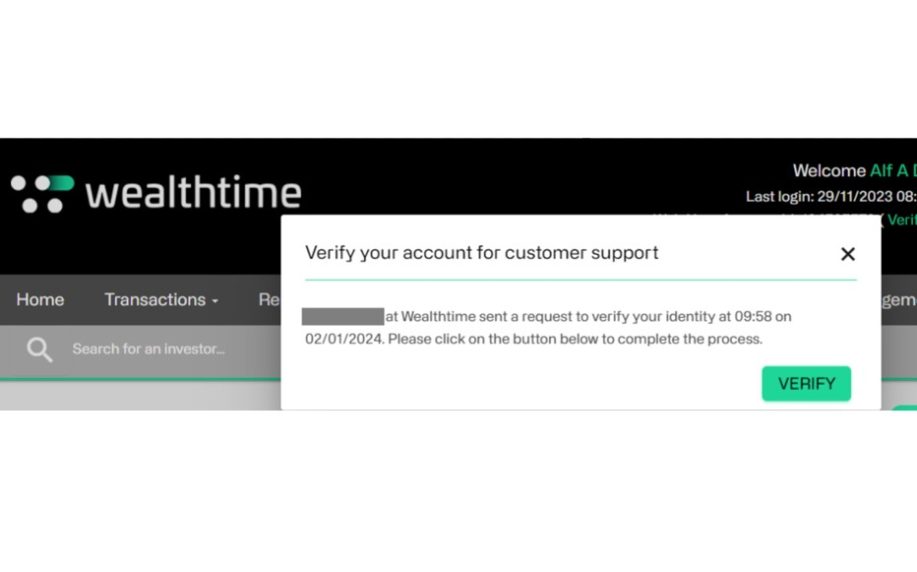

We want our users to take centre stage. From day one, you’ll get a service that’s designed around you. You’ll know your clients’ investments are protected and you can focus on achieving their desired outcomes. We offer a bespoke and tailored service, named points of contact and full platform training delivered by a dedicated team.

We believe in providing a highly personal service. And part of that is making sure our platforms and technology work to support you and your business now, as well as offer the flexibility required to meet your future needs. We made it our mission from the outset to develop a market-leading, legacy-free platform that makes administration processes easier. All to help you and your business remain productive and efficient, while giving you more time to spend with your clients.

What our technology approach means for you

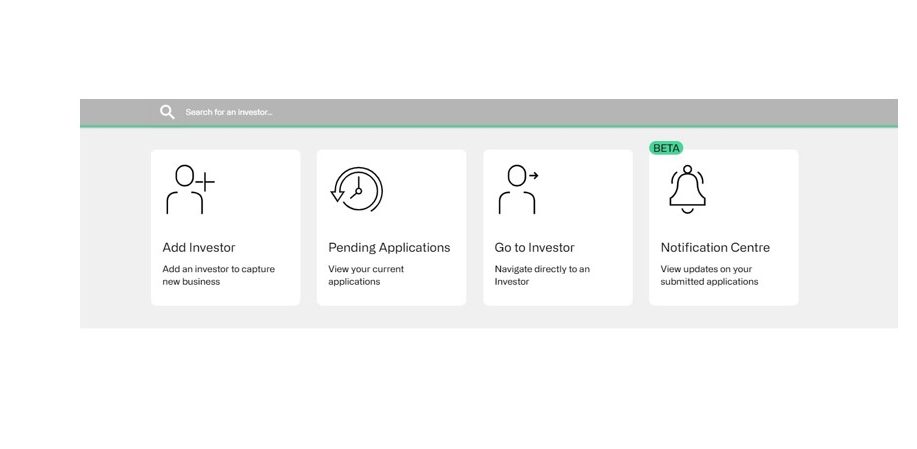

We know advisers are struggling to create more capacity in their business due to the lack of integration across technology solutions. That’s why we’ve transformed our approach to technology so you benefit from a well-integrated ecosystem and better external data integration. Our combination of GBST, microservices and proprietary technology enables us to continually improve our tools and services. Allowing us to anticipate and rapidly respond to our users’ evolving needs.